How To Find Ao Code For Pan Card In Hyderabad

Overview on AO Code for PAN: Types of AO codes, How to find AO code for pancard step by step process given below.

AO Code For PAN

PAN Card is an essential certificate for Indian citizens; it plays a meaning role in filing income tax. The card as well helps in purchasing items such as immovable property. During the PAN card application, the applicant has to fill the AO code section. The AO code is mandatory and helps in identifying the revenue enhancement jurisdiction that the cardholder falls under. AO means assessing officer, and the AO code shows the authority, which is linked to your taxation.

The income tax department learns well-nigh what they should accuse each person through this code. For residents, the taxation department will request revenue enhancement according to rules governing person. For companies, the law will depict the corporeality to pay. Individual taxation payment differs according to the AO code example. People serving in the army or authorities will pay differently from other self-employed or in other industries.

What is AO Code

The assessing officer is the betoken person from the income taxation department who will assess the filed income tax returns. The officer checks for all legalities, and if their discrepancies, he/she has the right to question the assessee. The income revenue enhancement department has AO appointed everywhere in the country. Each officeholder jurisdiction is given according to the income tax circumvolve or ward.

When applying for a PAN card, you must enter the AO code to determine your revenue enhancement law, which applies to your AO. For Indian citizens, at that place are set tax laws to govern their income revenue enhancement payment. These are different for non-citizens who have a unlike ready of rules. Every category has an AO based on the type of application or person.

AO CODE

The assessing officer code helps in learning the income revenue enhancement jurisdiction a taxpayer fall nether. The code is indicated on the PAN application grade to assist the income tax department allocating the amount to pay.

What are the components of an AO Lawmaking?

The AO code has several components, as follows:

- Surface area code

These the region the AO cover in his jurisdiction.

- AO blazon

This describes the assessing officer in terms of the ward, circle, range, or commissioner.

- Range lawmaking

The operating zone by which the AO officer should govern.

- AO number

Every AO has a unique number assigned to them.

AO code for PAN card. How to discover AO code for PAN

The income revenue enhancement department allows the applicant to access their AO code through an online portal or visiting the revenue enhancement offices. The AO codes may modify if the department implements new laws.

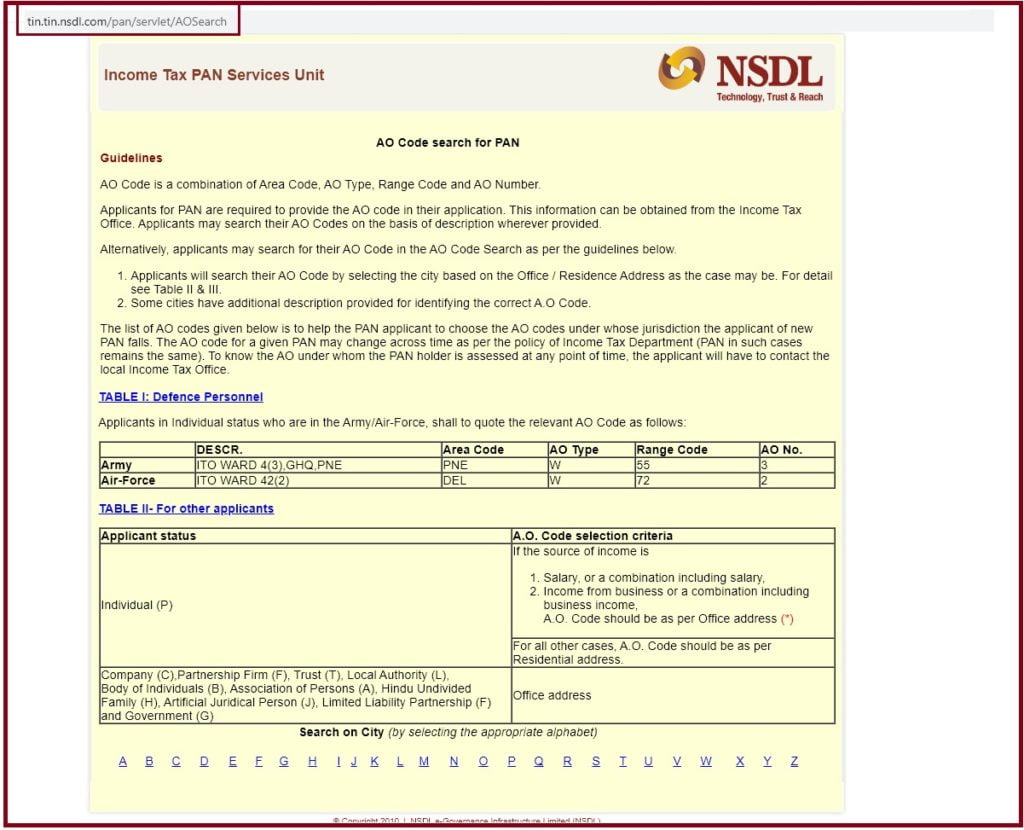

- Open the NSDL PAN website https://tin can.tin.nsdl.com/pan/servlet/AOSearch portal to get the AO code.

- On the menu, select the urban center of residence.

- The portal will provide a list of AO codes for your metropolis.

- At present select your area AO code according to the information.

- Next, click the submit button.

Knowing your Jurisdiction AO

Applicants can besides learn the AO through the steps below.

- Go to the income tax section PAN website portal.

- Adjacent, your PAN carte number and mobile number (registered with PAN card).

- Now click the submit button, the system will transport an OTP number. Utilize the number to authenticate all the details. Click the validate selection to continue.

- The page will brandish the jurisdiction AO information on the screen.

AO code Types

The AO code is divide into four types co-ordinate to the area in which the AO operates. There are different tax implications for each type. This means each AO gets various tasks for the ITR assessment every bit per the applicant.

International revenue enhancement

The section covers any entity, company, or foreigners who are not registered in India.

Non-international taxation (outside Mumbai)

These apply for companies, entities, or foreigners who accept registered anywhere in India except Mumbai.

Non-international revenue enhancement (Bombay region)

Whatsoever individual or company registered in Mumbai fall in this category.

Defense force personnel

These merely apply to individuals in the Indian ground forces or Air force.

How To Find Ao Code For Pan Card In Hyderabad,

Source: https://howtofill.com/ao-code-for-pan-card/

Posted by: arrudaporm1988.blogspot.com

0 Response to "How To Find Ao Code For Pan Card In Hyderabad"

Post a Comment